Want to Know How you can Legally Get Out of Paying up to 90% of your Tax Debt?

Find out now from our BBB A+ Rated Law Firm

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Atlanta, and All of Georgia

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Qualified Atlanta Tax Firm to Help You Today

Highly Experienced Atlanta Tax Lawyer

Among the worst things you can do with IRS back tax debt is continue to fail it for years at a time. The Internal Revenue Service likes to add on additional penalties and interest costs to the amount you owe, and certainly will stop at nothing to collect that money.

They’re the greatest collection agency in the world, and we firmly believe that no one should have to face them by themselves again.

For many people, having a government agency that is massive continuously harassing them with letters, notices and revenue officers is a dreadful thought.

That is why our Atlanta team is here to assist you. You will have someone in your corner, and no longer have to manage the IRS on your own.

With only 15 minutes on the telephone with our experts, you’ll understand precisely what you’ll qualify for, and what to do.

Give our office a call now!

Don't get conned by a tax relief company with no track record - call our BBB A rated business now.

Many people are law-abiding Atlanta citizens and they dread the risks of IRS actions. These firms entice innocent individuals in their scams and commit consumer fraud and even theft! There are numerous ways in which they fool people of their hard earned money: by charging upfront nonrefundable payments without supplying any guarantees, by misrepresenting future outcomes, by posing as a service provider and selling the sensitive information of the customers to other service providers, by outright larceny from customers and so on. Therefore, caution should be exercised by you when you’re trying to find a tax resolution business for yourself.

What Tax Relief Scams will do

Not all Georgia tax relief businesses who promise to negotiate together with the IRS for you’re trustworthy. Because there are so many fraudulent companies out there, therefore, preventing IRS tax aid scams is vitally significant. It’s possible to prevent being taken advantage of, all you have to do to follow a few tips that are useful and is to train yourself in this respect! First things first, never pay in full upfront whether the tax resolution company asks for it in the beginning or in an obscure manner at some point of time. A tax resolution company that is authentic will consistently folow a mutually acceptable financial arrangement wherein the payments can be made on a weekly, bi-weekly monthly or basis.

Secondly, it is best to be quite careful when you are picking a special tax resolution company to work with. Chances are the company is deceitful if they guarantee you the desired outcomes or state that you qualify for any IRS plan without going through a complete fiscal analysis of your present situation then. After all, without going through your complete fiscal analysis first, it is impossible for companies to pass such judgment. Consequently, don’t fall for their sugar-coated promises and hunt for other genuine firms instead.

How to research the firm

The internet is a storehouse of information, but you must be careful about using such information. Do not just hire any random firm with promotional efforts or great ads for handling your tax related issues. So, doing your assignments and investing time in research is certainly a shrewd move here.

A website that has a great evaluation on BBB is definitely one which you can place your trust in. We’re a BBB A+ rated Atlanta business, we help people by relieving their IRS back tax debts. Our tax options are reasonable, we don’t only negotiate on your behalf together with the Internal Revenue Service, but instead create a practical strategy first to be able to make sure that your tax debts are removed. We do all the hard work for you while you concentrate on different significant aspects of your own life. Because of our vast experience and expertise in the area, you can rest assured your tax problems would be solved effectively and promptly when you turn for help to us.

Quit letting tax liens command what you can do with the property you own - give our Georgia company that is a call

What is a tax lien?

The lien cushions the claim of the authority to all your existing property, inclusive of personal, financial and real estate assets. Liens normally record the exact figure owed to IRS in the precise time that it is imposed in a public document called the Notice of Federal Tax Lien. The file notifies lenders that the government has a right to confiscate your property at just about any given time. This particular info is conventionally obtained by credit reporting agencies that are different therefore tax liens finally reflect on your credit reports.

Federal tax liens can simply be avoided from being lodged by paying all your tax dues up and also before the IRS decide to levy a lien in your assets. They may also be evaded through establishing payment agreements which adequately match the demands of the IRS so as not to file a lien. A federal tax lien cannot be filed if a taxpayer decided to prepare a streamlined or guaranteed installment treaty. Such agreements require the taxpayer maintain a balance of $10,000 or an amount less than that for the bonded payment and for that is accord the streamlined agreement , it should be $25,000 or less. In a predicament where the taxpayer owes more than $25, 000, a tax lien can be prevented if he/she a streamlined accord. lays out tries their best to reduce that particular outstanding balance to just $25,000 or less and instead There are just two methods of removing tax liens: release and withdrawal.

What do I have to do to get my tax lien wiped away?

Getting federal tax liens is like it never existed when the IRS resort to revoking the lien. The lien is filled, lien withdrawals typically take place. In a case where the tax lien is erroneously filed, contact the IRS when possible. In order to substantiate you have no tax arrears then take the essential measures in withdrawing the lien the IRS agents will check your account.

Releasing a federal or Georgia state tax lien generally means that the lien that is imposed constrains your assets. Immediately after lien releasing, the county records will instantly be brought up to date to show that’s has been released. Nevertheless,the existence of a federal tax lien once will be shown in your credit reports for 10 years.

What to Do Next

To sort elaborate lien problems struck, for example discharge,withdrawal,subrogation and subordination (Set advisory group), Concluding fundamental lien issues, requesting or confirming a lien, releasing a lien (Centralized Lien operation), Guidance from organizations within IRS (Taxpayer Advocate service), Inquiring whether bankruptcy determined your tax arrears (Central insolvency operation),don’t be unwilling to see our offices to assist you in effectively removing your tax liens by settling your debts on program to prevent the government from seizing your property or instead you can give us a call and our Atlanta agents shall have the ability to assist you to browse through any impending federal tax liens.

You could lower your tax debt by 50% instantly simply by having the penalties and interest costs removed

Once the IRS hit on you or your business using a tax bill, it normally appends penalties and interest fees. These additional costs might be horrendous such that an old tax bill could have double in fees and interest pinned onto it. Some fees, like late payments, they can be included automatically by IRS computers.

The IRS supposes you admit them, in the event that you do not whine once penalties are imposed. Luckily, the IRS can confiscate a penalty just as simple as it included one. The key to the realm of the tax fee relief is revealing a reasonable reason for your letdown to obey with tax law.

The quantity of tax code fines that are different is staggering. Below are some of the penalties that IRS will tack on to the debts of individuals who’ve not filed their back tax debts.

Incorrectness:

The Internal Revenue Service will impose a 20 % fee on you if you greatly minimized your taxes or were negligent. This precision-linked fine is used when you are unable to set a deduction in a review, or you did not submit all of your income as well as the IRS learns it.

Civil deceit:

A fee 75% may be attached in case the IRS discovers that you weren’t reported your income with a deceptive aim.

Delayed Payment:

Typically, the Internal Revenue Service will add a fee from 0.25 % to 1% for each month to an income tax bill, which is not paid punctually. This late payment fine is when you make a delayed payment, or tacked on by the Internal Revenue Service computer whenever you file a tax return devoid of paying the outstanding balance. Fines for failing to make payroll tax deposits are considerably elevated.

Not Filing on time:

The IRS can fine you an extra 5% per month on any outstanding balance if you didn’t file your return punctually. However, this punishment can be employed only for the initial five months after the due date of the return, equivalent to a 25% higher cost. If there’s no outstanding balance, the IRS can still visit lesser punishments.

When you know how and the motive you were hit by the IRS with fines, you may need that they be abridged or removed. The IRS name for this process is called an abatement. About one-third of all tax fees are finally abated, and it’s going to be more if you understand the ways to contest them.

Just advising the IRS that you do not like a penalty, or cannot afford to compensate it, WOn’t work. You should show reasonable cause, which means a good supplication. In line with the IRS, any sound cause advanced as the reason for postponement by a taxpayer in filing a return, making deposits, when owed will be carefully examined, or paying tax.

Methods to request for an IRS penalty and interest abatement

Enclose the following documents with your written request.

- Letter from a registered medical practitioner, describing your state that prevented you from filing your tax return punctually.

- Death certificate substantiating the bereavement of close connections or your blood.

- A comprehensive report from the fire department if your property is damaged due to fire.

What to Do Now

In case you have been levied fees by the IRS, there are several simple and effective methods to get interest condensed or your tax fines or even eliminated absolutely. We’ve been for years in the business and we’re devoted to offer our customers a professional IRS fee and interest abatement service lawfully. Contact us today to resolve your tax problems all and the associated fees imposed on your Atlantacompany or on you by the Internal Revenue Service.

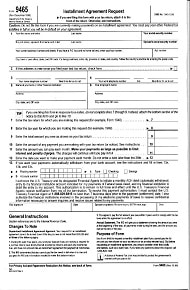

Instead of needing to pay all of you tax debt at once, let our Atlanta team negotiate a payment plan for you

As long as their tax debt is paid by the taxpayer in full under this particular Arrangement, they could reduce or get rid of the payment of interest and fees and prevent the payment of the fee that’s associated with creating the Agreement. Establishing an IRS Installment Agreement requires that all necessary tax returns are filed prior to applying for the Understanding. The taxpayer cannot have some unreported income. Individual taxpayers who owe $50,000 or less in combined individual income tax including penalties and interest can receive 72 months to pay the amount of tax owed .

Good Parts about an Payment Plan

The agreement will result in a few important benefits for the taxpayer. While an agreement is in effect enforced collection activity WOn’t be taken. Life will be free of IRS letters and notices. When the taxpayer can count on paying a set payment every month rather than having to agonize about getting lump sum amounts on the tax debt there’ll be more financial freedom. The taxpayer will eliminate ongoing IRS penalties and interest. The Internal Revenue Service will help the taxpayer keep the arrangement in force if the taxpayer defaults on a payment providing the IRS is notified instantly.

Obligations of the Installment Agreement Compromise

Some obligations include the Installment Agreement. When due, the minimum payment should be made. The income of an individual taxpayer or the incomes of combined taxpayers should be disclosed when putting in an application for an Installment Agreement. In some instances, a financial statement must be provided. All future returns should be submitted when due and all of the taxes have to be paid when due. Citizens paying their tax debt under an Installment Agreement may be asked to authorize direct debit of their checking account. This way of making monthly payments enable the taxpayer to request that the lien notice be withdrawn. In the event the taxpayer defaults on the Installment Agreement, but, the lien can be reinstated.

The taxpayer and the IRS can negotiate an Installment Agreement. However, specific information must be supplied and any advice might be subject to confirmation. For taxpayers a financial statement will be required.

How to Prepare to Apply for an Installment Agreement

While taxpayers can make an application for an IRS Installment Agreement, there are some precautions that should be contemplated. Although the IRS attempts to make applying for an Installment Agreement a process that is relatively easy, there are some circumstance which can make this a challenging endeavor. It is crucial to get it right the first time the application is made since many issues can be eliminated by an Installment Agreement with the Internal Revenue Service.

We are the BBB A+ rated law firm serving all of Atlanta and Georgia, which could offer you skilled assistance. Our many years of experience working on behalf of citizens that have problems with the Internal Revenue Service qualifies us to ensure approval of your application for an Installment Agreement.

The very best method of finally getting out of debt is to use the expertise and knowhow of a reputable law firm serving Atlanta

Have you ever been struggling with your back tax debts for several years, and are eventually fed up with dealing with the Internal Revenue Service on your own?

Have they began sending letters and notices to your home or business, demanding you pay interest charges and extra fees for the amount you owe?

If so is hire a tax law business that is experienced and reputable to be by your side each step of the way. The great news is, our Atlanta company is the perfect candidate for the occupation, with an A+ company standing with the BBB, thousands of satisfied customers around the country (especially in delightful Georgia), and our own team of tax lawyers, CPAs and federally enrolled representatives, all ready to work on your own case today.

The IRS is the biggest collection agency in the world, with a large number of billions and revenue officers of dollars set aside to chase great, hard working people like you for the money you owe. The sole thing they care about is getting the money they are owed. You shouldn’t have to confront them by yourself. We don’t get bullied around like regular citizens can use our private contacts to negotiate the resolution that you need, and do.

Using seasoned Atlanta legal counsel on your tax issues is like having an expert plumber come and repair your massively leaking water main. Certainly you could probably finally learn how exactly to repair it by yourself, but by the time you do, your home is most likely permanently damaged from leaking, and will cost a lot more than simply hiring the expert in the very first place.

Our crew of experts is standing by, ready to help you!

Remove Wage Garnishments Quickly

![]() Another one of our standard services is to help get wage garnishments removed from your paycheck. Though the IRS may feel like this scare tactic prompts individuals to pay off their tax debt more quickly, in reality it only embarrasses them and damages their public reputation. Essentially, a wage garnishment is a garnish placed on your paycheck. This garnish allows the IRS to take up to 25% of your hard earned money to pay back the amount you owe.

Another one of our standard services is to help get wage garnishments removed from your paycheck. Though the IRS may feel like this scare tactic prompts individuals to pay off their tax debt more quickly, in reality it only embarrasses them and damages their public reputation. Essentially, a wage garnishment is a garnish placed on your paycheck. This garnish allows the IRS to take up to 25% of your hard earned money to pay back the amount you owe.

Again this may seem unfair, but it is completely legal. If you have had the unfortunate problem of getting a Wage Garnishment placed on your paycheck, then you need to act quickly to get it removed.

Do you really think your boss is going to reach well with the IRS calling him and asking to take a portion of your wages? Do you think your boss will continue to trust him or that your still going to be considered for the next big promotion? Probably not.

Back Tax Returns

The IRS, as a government agency, constantly requires you to jump through hoops. They require you to fill out a lot of paperwork and, unfortunately, it is easy to make a mistake or accidently miss something. Our firm helps make sure that individuals stay on top of all of their paperwork, especially their back tax returns.

One of the easiest ways to become ‘compliant’ again in your payments is to go back and file all of your back tax returns for previous years. You may have neglected these payments in the past without understanding how you would be financially affected in the future. Luckily, we can help you file these returns and successfully wade through this swamp of paperwork.

Get Help Today

Atlanta is a special city filled with incredible people. It’s such a shame that so many individuals and families have been hit hard financially in recent years. If you’re one of these people and you have fallen into debt with the IRS, you should contact our qualified tax relief firm. We exist to serve you and help you survive some of the most difficult experiences of your life.

If any of the nightmares listed above are indeed your reality, you can contact our qualified tax relief firm to set up a free consult today. No one should have to deal with these problems on their own. We have a highly qualified team of experts that includes lawyers, CPAs, consultants and registered agents that will work in tandem to save you money and help you escape your debt with the IRS.

Too many Atlanta citizens are currently facing similar situations and we want to remedy this situation. We care too much about our neighbors and our community to let it drown in the bureaucracy of the IRS. We’re here to help you; no matter your problem with the IRS. If you live in Atlanta or in the Atlanta area, contact us as soon as you can. Regardless of what is going on with your life, will to everything in our power to help you and keep you from drowning in debt.

Serving All of the Atlanta Area

![]() We are proud to serve the entire Atlanta metro area, including:

We are proud to serve the entire Atlanta metro area, including:

- Athens

- Sandy Springs

- Marietta

- Northwestern

- Buckhead

- Southwestern

- North Druid Hills

- Decatur

- Midtown

- Smyrna

- Mableton

- Woodstock

- Kennesaw

- Roswell

- Alpharetta

- Johns Creek

- Duluth

- Tucker

- Brookhaven

- Carrollton

- McDonough

- Gainesville

Other Cities Around Atlanta We Serve

| Address | Atlanta Instant Tax Attorney1349 Peachtree St NW, Atlanta, GA 30309 |

|---|---|

| Phone | (404) 341-4333 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Atlanta We Serve | Acworth, Alpharetta, Atlanta, Austell, Avondale Estates, Clarkdale, Clarkston, Conley, Conyers, Dallas, Decatur, Douglasville, Duluth, Ellenwood, Fairburn, Fayetteville, Forest Park, Grayson, Hampton, Hiram, Holly Springs, Inman, Jonesboro, Kennesaw, Lawrenceville, Lebanon, Lilburn, Lithia Springs, Lithonia, Loganville, Lovejoy, Mableton, Marietta, Mcdonough, Morrow, Norcross, North Metro, Palmetto, Peachtree City, Pine Lake, Powder Springs, Red Oak, Redan, Rex, Riverdale, Roswell, Scottdale, Smyrna, Snellville, Stockbridge, Stone Mountain, Suwanee, Tucker, Tyrone, Union City, Winston, Woodstock |